Monroe Township Boasts Second Lowest Tax Rate in Middlesex County

Mayor Dalina Credits Lean Municipal Budget and AA+ Bond Rating

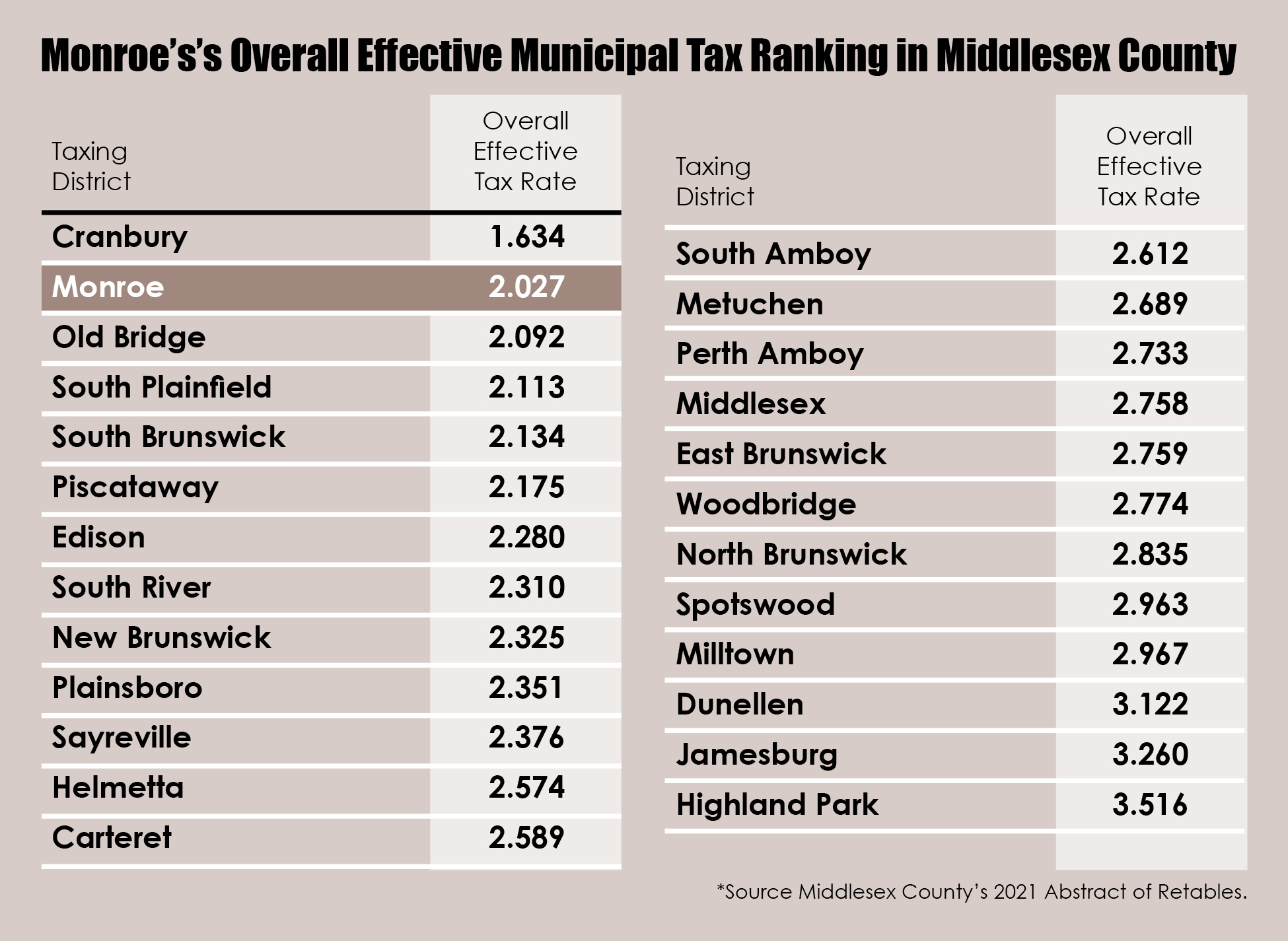

MONROE TOWNSHIP– October 15, 2021 – Monroe Township Mayor Dalina and Township Council announced today that the Township has the second lowest overall effective tax rate in Middlesex County according to the 2021 Abstract of Ratables just released by the Middlesex County Board of Taxation.

The report lists Monroe Township’s effective tax rate of 2.027, the second lowest in comparison to the County’s 25 municipalities.

“This ranking is a result of a slight municipal tax rate reduction in 2021 – despite the COVID pandemic – from $.493 to $.489 per $100 assessed value,” said Mayor Stephen Dalina. “It also is attributable to our AA+ bond rating which is the second highest rating assigned by Standard & Poor and only awarded to 10% of municipalities nationwide.”

The state defines an effective tax rate as “a statistical study that enables the comparison of one district to another based on the assumption that all districts are at 100 percent valuation. This rate is not to be used to compute the tax bill.”

“Monroe Township provides a wide variety of quality programs and services to our residents that is unparalleled elsewhere in the County and our comparably low tax rate shows that we offer among the best value in the County,” said Mayor Dalina. “We also continue to have among the lowest residential water and sewer service fees in the region.”

The Monroe Township municipal tax rate has seen a less than 1% average increase over the past seven years. Water and sewer rates remained the same in 2021.