November Update: Less Than 50 Days Left to Apply for ANCHOR Property Tax Relief Program Township Offers Residents Assistance Completing ANCHOR Applications

November Update: Less Than 50 Days Left to Apply for ANCHOR Property Tax Relief Program

Township Offers Residents Assistance Completing ANCHOR Applications

MONROE TOWNSHIP – November 14, 2022 – Monroe Township Mayor Stephen Dalina and Township Council would like to remind all Township residents that there’s less than 50 days left to apply for the ANCHOR Property Tax Relief program before the December 30 deadline.

While many residents will be able to complete and submit the forms themselves, the Township encourages those needing assistance to visit or call the Township Tax Collector’s office at 732-521-4405 or the Monroe Township Public Library at 732-521-5000.

"Thanks to our efforts over the past year fighting for property tax relief and communicating our needs to the Governor’s office, the ANCHOR program is now in place. We encourage every eligible Monroe resident to take advantage of this meaningful benefit,” Mayor Dalina said. “We have been fighting to make Monroe more affordable for our residents and ANCHOR is a big step in the right direction.”

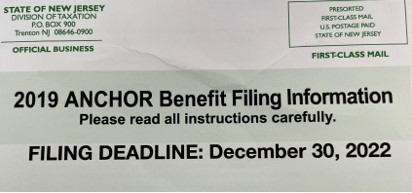

The application pictured here is what residents can expect to receive from the NJ Division of Taxation.

Please note: The deadline for application is December 30, 2022.

Residents are reminded to have the following items available for reference when calling for assistance: Anchor application with ID number and pin if available, 2019 tax return and social security number. Staff members will work with residents to complete and submit their filing either via telephone or online.

Some technical questions may still need to be dealt with by the state by calling the ANCHOR hotline at 888-238-1233. Call volumes are high given the number of people throughout the state trying to get through so residents are cautioned to expect extended wait times and encouraged to keep trying.

“The filing process may not be perfect, but we are here to help, and you have until December 30, 2022 to apply so don’t panic,” Mayor Dalina said. “We will work with our residents over the coming weeks and months to help get those applications in on time.”

ABOUT THE ANCHOR PROPERTY TAX RELIEF PROGRAM

The ANCHOR program, short for Affordable New Jersey Communities for Homeowners and Renters replaces the Homestead Rebate. The new program income limits and other qualifications are different from the Homestead Rebate so more residents will be eligible. There are no age restrictions.

The program, covering the 2019 year, will provide credits of up to $1,500 to taxpayers with 2019 gross incomes up to $150,000, and up to $1,000 for those with gross incomes between $150,000 and $250,000. Tenants with gross income up to $150,000 can qualify for a benefit of up to $450.

Benefits are expected to be paid out via direct deposit or check by May 2023, the Treasury Department said. All applicants are encouraged to “triple-check” to ensure that all information entered is 100% correct prior to submitting the application.

If you owned a home in New Jersey on October 1, 2019, you may qualify even if you sold the home. You do not have to be a current resident to apply. Call the hotline If you did not receive a notice by mail or email. New residents must wait for subsequent years to apply. Changes to mailing addresses can be make when filing the application. For additional information, visit https://www.state.nj.us/treasury/taxation/anchor/general-faq.shtml.