2020 2nd Quarter Property Taxes

IMPORTANT NOTICE:

Due Date: May 1, 2020

Last Day of Grace Period: May 11, 2020

THE MUNICPAL BUILDING IS CURRENTLY CLOSED TO THE PUBLIC

DUE TO THE GOVERNOR FREEZING THE STATE BUDGET, HOMEOWNERS WILL NOT BE RECEIVING A HOMESTEAD CREDIT ON THE 2ND QUARTER 2020 PROPERTY TAXES

Tax Payment Options

Mail- You may mail your check or money order to our office. The payment must be received in our office by May 11th to avoid interest charges, postmarks not accepted.

Please mail payments to:

Monroe Township Tax Collector

1 Municipal Plaza

Monroe Township, NJ 08831

Online Payment- Online payments can be made through our WIPP portal, however fees apply. Payments can be made on https://wipp.edmundsassoc.com/Wipp/?wippid=1212 with a credit card (2.95% fee) or with an e-check ($1.05 fee).

ACH Program– Residents may enroll in our free ACH Direct Debit plan where your payment would be debited directly from your checking or savings account quarterly. You may contact our office for a form, or download the form off of the Tax Collector page on www.monroetwp.com. Please have the form and a void check submitted to our office no later than April 27, 2020 for you to be enrolled starting for the 2ndquarter, which will be debited from your account on May 4, 2020.

Online Bill Pay– Online bill pay may be set up through the customer’s bank. Please contact your bank with any questions regarding this option.

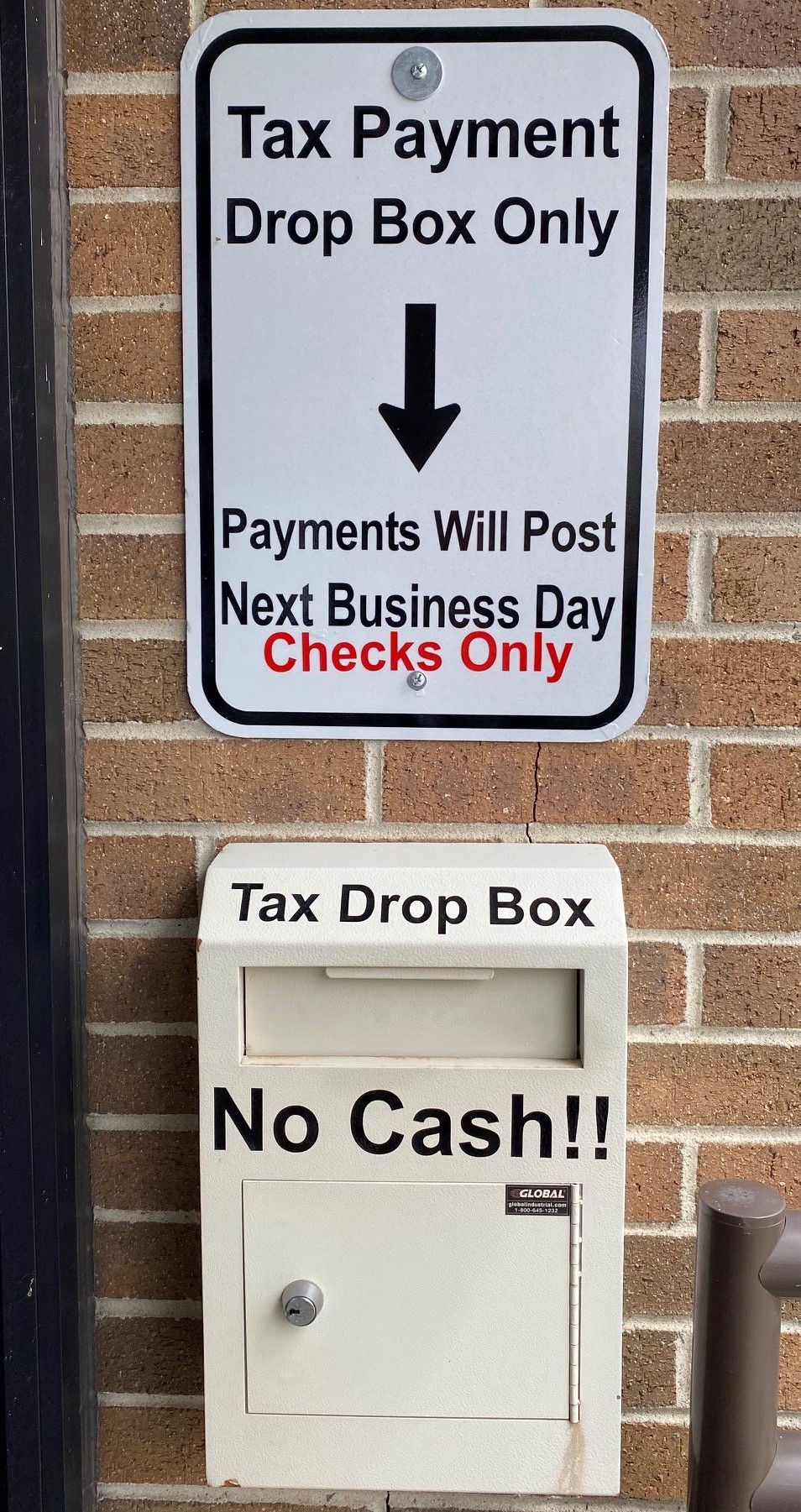

Drop Box- There is a Drop Box located outside of the front entrance of the building, which a payment can be placed in at any time. Please only put checks or money orders in the drop box. We cannot accept cash.

If you have any questions, please call the Tax Collector’s office at 732-521-4405

Please refer to the Division of Taxation’s website if you have questions regarding the Property Tax Reimbursement Program (Senior Freeze) or the Homestead Benefit Program – https://www.state.nj.us/treasury/taxation/relief.shtml