Important Message from the Tax Collector: State Budget Delay Requires “3rd Quarter Estimated Taxes”

IMPORTANT MESSAGE FROM THE TAX COLLECTOR:

Message from the Monroe Tax Collector Samantha Rampacek

State Budget Delay Requires “3rd Quarter Estimated Taxes”

July 16, 2020

Dear Resident,

I am writing today to provide some clarity about the 3rd quarter estimated bills that you will receive shortly in the mail.

As a result of the COVID-19 health crisis, the State of New Jersey notified all municipalities of a delay in the adoption of the State Budget and has recommended that 3rd quarter estimated tax bills be prepared and mailed.

Under normal circumstances, each year in July, the Township mails out your tax bill that includes quarterly stubs for the next four tax payments. This year, however, because of uncertainty in state funding, it will be different.

Because the state and county have not yet certified tax rates for the next year, the Township can only send out the bill with 3rd quarter estimated information included.

As you will soon see, the 3rd quarter estimated bill reflects the estimated 2020 rate less payments made in the first two quarters of 2020 that were based on the 2019 final rate without any 2020 increases. (IMPORTANT: Please do not multiply your estimated 3rd quarter tax bill by four to get your annual taxes owed as this calculation will be incorrect.)

Once the tax rates are certified, you will receive a reconciled and final 2020 tax bill along with the three remaining tax payment stubs. That mailing is anticipated to be ready for distribution in September for the November tax bill.

As a reminder, 3rd quarter estimated taxes are due on August 1st and, as always, there is a grace period of ten days.

In light of the COVID-19 financial uncertainty, the State of New Jersey allowed municipalities to extend the second quarter tax grace period from 10 days to 30 days. We have not yet been notified if the same extension will be authorized for the third quarter payment. Of course, we will notify you of any changes via the Township website and Nixle if this extension is granted once again.

For more information on how to pay your bill, visit https://www.monroetwp.com/index.php/departments/tax-collector.

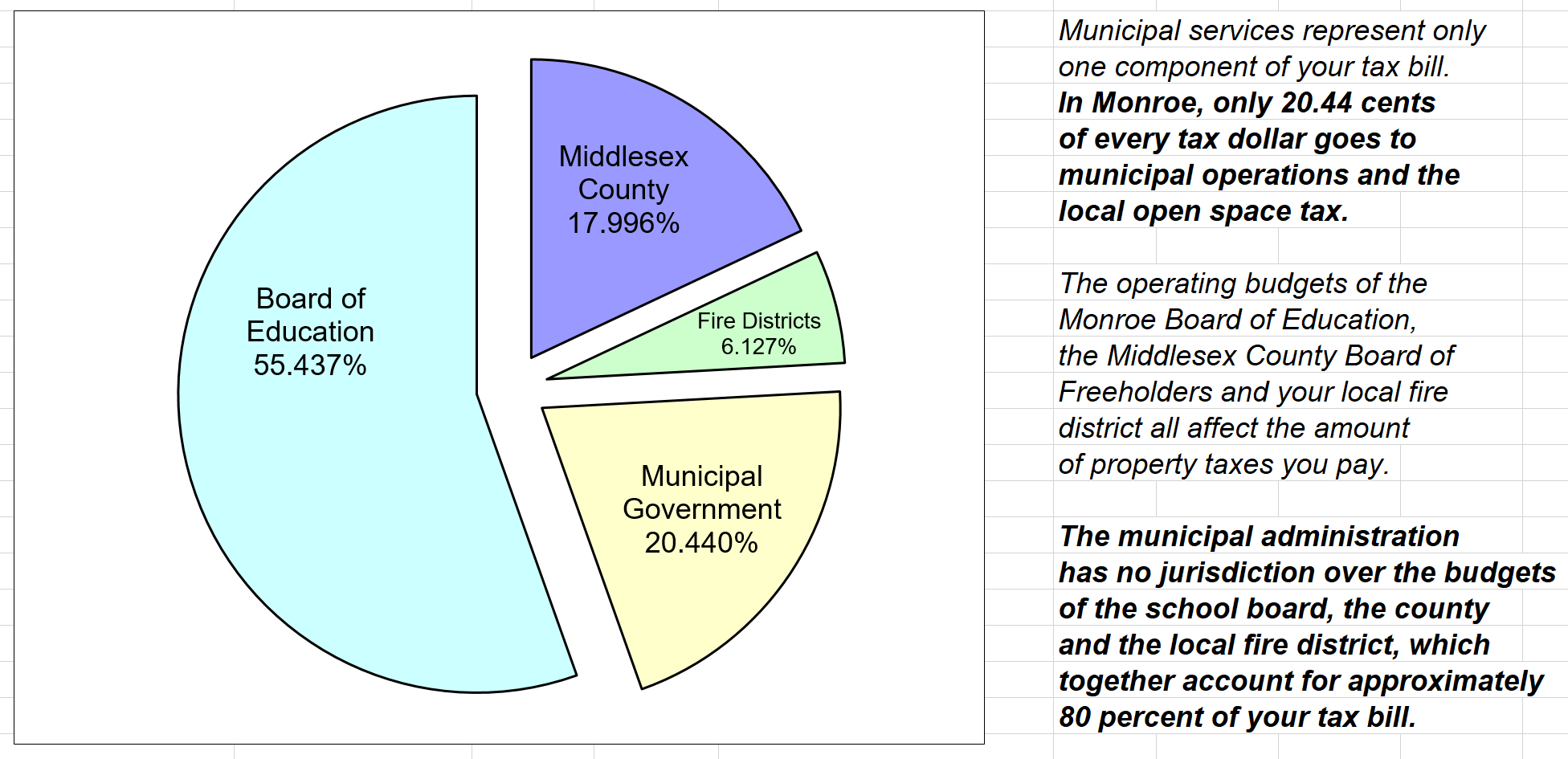

Feel free to call my office at 732-521-4405 if you have any questions. For your reference, below is a breakdown of the estimated 3rd quarter tax bill by source.

Samantha Rampacek, Tax Collector

3rd Quarter Estimated Bill: Tax Bill Breakdown

2020 3rd Quarter Property Taxes

Due Date: August 1, 2020

Last Day of Grace Period: August 10, 2020

As per state law, any payments received after August 10th would accrue interest back to August 1st

THE MUNICPAL BUILDING IS CURRENTLY CLOSED TO THE PUBLIC

DUE TO THE STATE BUDGET DELAY, HOMEOWNERS WILL BE RECEIVING AN

ESTIMATED 3RD QUARTER 2020 TAX BILL

Tax Payment Options

Mail - You may mail your check or money order to our office. The payment must be received in our office by August 10th to avoid interest charges, postmarks not accepted.

Please mail payments to:

Monroe Township Tax Collector

1 Municipal Plaza

Monroe Township, NJ 08831

Online Payment - Online payments can be made through our WIPP portal, however fees apply. Payments can be made on www.EdmundsGovPay.com/Monroe with a credit card (2.95% fee) or with an e-check ($1.05 fee).

ACH Program – Residents may enroll in our free ACH Direct Debit plan where your payment would be debited directly from your checking or savings account quarterly. You may contact our office for a form, or download the form off of the Tax Collector page on www.monroetwp.com. Please have the form and a void check submitted to our office no later than July 27, 2020 for you to be enrolled starting for the 2nd quarter, which will be debited from your account on August 4, 2020.

Online Bill Pay – Online bill pay may be set up through the customer’s bank. Please contact your bank with any questions regarding this option.

Drop Box - There is a Drop Box located outside of the front entrance of the building, which a payment can be placed in at any time. Please only put checks or money orders in the drop box, no cash.

If you have any questions, please call the Tax Collector’s office at 732-521-4405

Please refer to the Division of Taxation’s website if you have questions regarding the Property Tax Reimbursement Program (Senior Freeze) or the Homestead Benefit Program – https://www.state.nj.us/treasury/taxation/relief.shtml